Explain Depreciation and Its Different Methods

In year one of the bouncy castles 10-year useful life the equation looks like this. Identify the different types of ledgers used by a construction company.

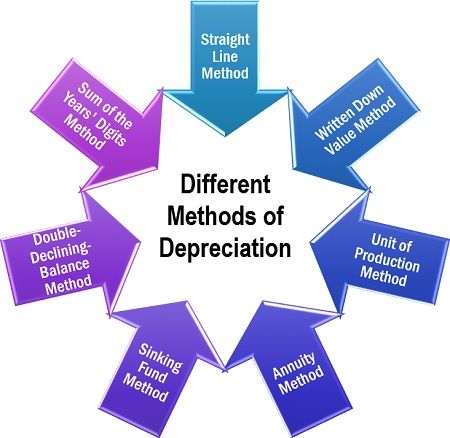

Different Methods Of Depreciation Definition Factors The Investors Book

Summary and detailed examples.

. Excel matrices methods which can design and handle complicated situations of service departments make the reciprocal approach easier to use than before. In the following sections well explain each of these valuation methods and the situations to which each is suited. Youll write off 2000 of the bouncy castles value in year one.

Each method has advantages and drawbacks. Using these simplified methods can sometimes result in tax savings and streamline the tax return preparation process and recordkeeping requirementsFrom 6 April 2017 the cash basis also becomes the default accounting basis for unincorporated businesses with rental income of 150000 or less. For tax purposes they want the expense to be high to lower taxes.

These are the words used by many ACCA financial management tutors including myself when introducing this topic to students preparing for Advanced Financial ManagementThe words imply that when trying to value the equity capital of a business there is range of possible correct answers all of which can be justified as being the. The straight-line depreciation method is a preferred method for calculating asset depreciation costs because it only requires the use of three different variables purchase price salvage value and useful life span. This is the final article in the series of three which consider the accounting for property plant and equipment by applying IAS 16 Property Plant and EquipmentThis is a particularly important area of the Financial Reporting FR syllabus and is also important assumed knowledge for the Strategic Business Reporting SBR exam.

This four-year liberal arts institution was founded in 1873 by the Freedmans Aid Society of the Methodist Episcopal Church. Since the asset is depreciated over 10 years its straight-line depreciation rate is 10. Disadvantages of using straight-line depreciation.

2 x straight-line depreciation rate x book value at the beginning of the year. Thank you for reading this guide to the purpose behind the double declining balance depreciation method. Importance of Cost Allocation Even though service departments are not often involved in the direct manufacturing of services or goods they are crucial in driving an organizations processes to function.

Depreciation is a tax accounting method by which an assets cost is allocated over the duration of its useful life using one of several generally accepted depreciation formulas. Business valuation is an art not a science. Sometimes assets appreciate in value and sometimes they depreciate.

When this happens a business owner can write the depreciation off against their income. New to Coursework Hero. Service to humankind is encouraged and nurtured at Wiley.

Types Of Valuation Methods. Minimal variables used. Three main types of valuation methods are commonly used for establishing the economic value of businesses.

Steam or electric power generation property section 263a for an applicant changing its method of accounting for its treatment of expenditures on generation property as defined in section 401 of Rev. Specify the types of financial difficulties to which the construction industry is subjected. Your personal details remain confidential and wont be disclosed to the writer or other parties.

Different companies may have different policies for recording the same accounting transaction. But if they sell the asset Uncle Sam is going to recapture part of that depreciation. Because assets tend to lose value as they age some depreciation methods allocate more of an assets cost in the early years of its useful life and less in the later years.

1142 to use all or some of the unit of property definitions and the corresponding major component. For example if you implemented a constraint analysis system this might lead to a reduced investment in fixed assets whereas a ratio analysis might conclude that the company is letting its fixed asset base become too old. Specify the various causes of contract claims.

Sign up Save. For investors they want deprecation to be low to show higher profits. 5 Common Depreciation Methods and Applications.

Educating students who are prepared for leadership and service when they graduate. We accept only Visa MasterCard American Express and Discover for online orders. Finally this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F Form 1040 or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under.

Cite the different types of clauses that may be added to a construction contract. Companies can and do use different depreciation methods for each set of books. Specify the components of a work breakdown structure.

Market cost and income. To understand aircraft depreciation rules we must first explain the basics of depreciation for both IRS and GAAP. When businesses spend capital on long-term assets such as airplanes helicopters buildings factories and machines they know that the assets value will decline as time goes by.

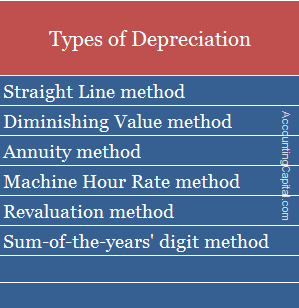

What Is Depreciation Types Examples Quiz Accounting Capital

Depreciation Methods 4 Types Of Depreciation You Must Know

What Is Depreciation Definition Objectives And Methods Business Jargons

Depreciation Definition Types Of Its Methods With Impact On Net Income

No comments for "Explain Depreciation and Its Different Methods"

Post a Comment